Afterview

Interview Recordings Refined

Navigating through verbose or unclear speech in interviews often results in slow reading and missed insights.

While AI summaries offer a high-level overview, they frequently overlook crucial details.

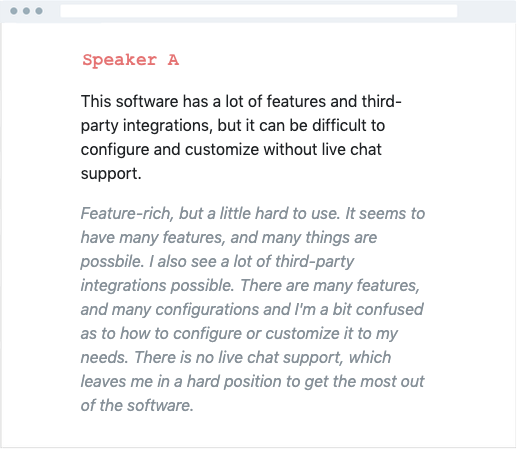

Afterview not only transcribes your interviews but also meticulously refines speech for brevity and clarity to ensure you capture every signal.

Example

In this Interview transcript the President of Market Research firm Sago talks about it with Greenbook

Lenny

Hello, everyone. I'm Lenny Murphy, and this is the GreenBook Podcast. Thank you for joining me and my special guest, Isaac Rogers, the president of Sago. Welcome, Isaac.

Hello, everybody. It’s Lenny Murphy with another edition of the GreenBook Podcast. Thank you so much for taking time out of your day to spend it with me and my guest. All my guests are special, you know that by now. I sound like a broken record, but you know, some closer to home and today’s guest is one of those. Isaac Rogers, president at Sago. Isaac, welcome.

Isaac

Nice to meet you, Lenny.

Pleasure to be here, Lenny.

Lenny

Isaac and I have known each other for a very long time.

So, I say this is special because Isaac and I have known each other for way longer than probably either one of us would want to admit.

Isaac

I've known you for most of the 15 years I've been in the industry, so it's safe to say it's been more than a decade.

Oh, more than a decade, I think it is safe. I’ve been in the industry 15 years, so I know I’ve known you the majority of that.

Lenny

In the past, during the 20|20 days.

Yeah, absolutely. So, back in the 20|20 days.

Isaac

I believe you were at Rockhopper when we first met, which was a long time ago.

Well, actually, I think you were at Rockhopper at the time, I think. And so, that’s how I got introduced to you, so that’s—that really puts it back a long way.

Lenny

You are going back 15 years. It's nice to have you on. I went to an event with P&G and Isaac presented interesting internal data collected by Sago. This information is not available elsewhere, even in GRIT. That's why I wanted Isaac to come and share this great information. Also, there's a story about the transformation of Sago, Schlesinger to a new entity. Isaac, introduce yourself and talk about Sago, and then we can discuss the interesting topics.

You are definitely taking it back to the 15-year mark, for sure. So anyway, it’s a pleasure to have you on. And for our audience, I recently had the opportunity to go to an event with P&G, and Isaac presented some internal data that Sago has been collecting around changes they’re seeing in project type and volume and quality that I just thought was really, really interesting and we’re not getting anywhere else, even GRIT, you know? We don’t get that type of information. So, that’s the core of why I wanted Isaac to come because I think that there’s just a lot of great information there to share. But also, there’s a little bit of a story that I think we can catch up on, and that’s the transformation of Sago, Schlesinger to this new entity, which is my long-winded segue, Isaac. Why don’t you introduce yourself to the audience, talk a little bit about Sago, and then we can go into kind of the cool stuff that I thought oh, this would be really great to talk about.

Isaac

I have been in the market research industry for about 15 years and have worked for companies that have grown to become some of the largest providers in the world. We offer a wide range of research services and work with clients globally. Recently, we conducted a data project to analyze trends in qualitative research post-Covid and found some significant findings. We have been presenting these findings to the industry and have received interest from clients who want to learn more about the changing landscape and how to adapt to it. The impact of Covid on the market research space is still a hot topic and people are looking for ways to stay ahead of the changes.

Hey, thanks, Lenny. So, first of all, you know again, pleasure to be here. Love talking about the market research space, the industry, and what’s going on. I have been fortunate, been in the industry about 15 years now. As you mentioned, I joined a little company called 20|20 Research that grew and became one of the world’s largest digital qual providers. We then became part of what was at the time Schlesinger Group, which is one of the world’s largest—or at the time, the largest qualitative provider. And we keep growing and growing. We are now one of the world’s most diversified and one of the largest partners to market researchers and brands around the world. So, we do several 100 million dollars worth of research services every year, data collection, quant qual, digital qual, you name it. We are a global organization, do most of our work here in North America and Europe, but with our quant divisions, with our digital qual divisions, we’re doing research all day, every day, for about 2600 clients around the world. I have the honor and pleasure of being our president, so all of the business units roll up into me and so I keep an eye on what’s going on generally in our quantitative practice, our qualitative practices, and we’ve got some professional services practices as well. So, we are what I would consider to be a very diverse provider. Which is one of the reasons that we started looking at this presentation because we were having conversations with folks about, you know, what was going on right at the tail end of Covid, with qualitative. Specifically, people were thinking more in person, but people kept coming up to me and being like, “What do you think about, you know, what’s going on in qual?” And I would have answers and, you know, provide kind of my, like, general opinion. And I was actually talking to an industry individual, a person that runs a trade show, and I was like, “Yeah, you know, people keep asking me like, ‘What’s going on in qual,’ and, ‘What’s going on post-Covid?’ And, ‘What are the trends?’” And I was like, “You know, you guys really should do a presentation or something on that.” And she goes, “Well, you know why they’re asking you, right?” And I was like, “Well, no.” And she goes, “Well, you’re one of the biggest providers in the world. You should have a point of view on this. Like, you’re probably sitting on a ton of data.” And it turns out we are. We do probably more—or enable more—qualitative research than anybody else on Earth. And so, I said, “That’s probably not a bad idea.” So, I worked with our team. And I thought it was going to be a quick and easy little data project and we were going to look across all of our in-person research, our digital research, and come up with some trends. And it turned out to be a much bigger project than I anticipated. We spent a better part of three months digging into our data about what’s going on with respondent engagement, what people are doing in in-person facilities, what people are doing differently post-Covid and we came up with four or five pretty major findings. Started presenting those to the industry in the spring of this year and we’ve had the honor of presenting, I think, four or five different times. And then mentioned to you right before we get started with the recording, and we’ve got clients that are coming to us, like, a—like, today going, “Hey, can we talk a little bit more about that because we’re starting to see some of those trends that you mentioned in your presentation. What should we do different? What’s going on with respondent engagement? Why are things continuing to change post-Covid? We thought things would settle back down at some point.” And so, it’s still a hot topic for folks even, you know, call it you know, 6, 9, 12 months post-Covid, having a huge impact on the space. They’re still wondering, like, “Where’s all this change coming from? And what’s happening? And more importantly, how do we get in front of it?”

Lenny

The problem is how do we address it? Let's explore it instead of me talking too much. There were many interesting things, some expected and some surprising.

That is the issue, isn’t it? How do we get in front of it? Well, let’s dive in, right, rather than me pontificating. So, I think that there was an awful lot of really interesting things that some were, kind of a yeah, we assumed this is what was happening and how things were going to go, some that were pretty darn surprising.

Isaac

In-person qualitative research has seen a partial recovery since the Covid-19 pandemic, with about 35 to 45% of pre-Covid levels. However, the nature of the research conducted in these facilities has changed significantly. Traditional focus groups and interviews have decreased by around 70%, while product testing and usability testing have become more common. Researchers have realized the benefits of online research, such as a wider audience and convenience for participants. As a result, focus group facilities may need to adapt their physical layout to accommodate different types of research in the future.

Yeah, absolutely. And so, the questions that continue to come up are, so what’s going on with in-person qualitative research? And so, we looked across our entire dataset, every group we’ve done over the past five years, categorized, organized, and came up with several trends. So, the first thing people say is, you know, “Are people really back doing in-person work?” And the answer is actually, yes. So, in-person research, we believe is somewhere between 35 and 45% back to pre-Covid numbers. So, that is measured on the volume of research that’s occurring in in-person facilities. So, a little less than half of what it was. Now, I think most people nod their heads and go, “Well, that makes, kind of, sense.” Like, just, you know—I think actually, some people are surprised the number is that big. Actually, the folks I was talking to earlier today, I asked them what they thought it was, and they thought it was maybe 10%, 15% of what it was pre-Covid. But it’s probably closer to that 35 to 45% range. Now, what’s actually interesting is what we do in those facilities has changed pretty dramatically. So pre-Covid, you know, you would sit a focus group of six or eight folks to talk about advertising cat food, whatever the general research objective was, and then, you know, you would do these, what we would call kind of non-traditional or non-typical groups for jury work, clinical research, product habits, and taste tests. And those were, you know, tucked in there, and they were nice, you know, maybe 20 25% of the work, but the lion’s share was, you know, getting six or eight consumers around a table, getting a bunch of physicians around a table or doing IDIs and just having a conversation with them about a product concept or usage behaviors. That has not come back. So, in that, call it let’s say, 40% back to pre-Covid numbers, a minority of that work is sitting six or eight consumers around a focus group doing IDIs, and in-person research. That has predominantly stayed online. Researchers have realized the benefit of a nationwide audience, frankly you know, you and I are both calling in from home, people don’t love getting in their cars and driving downtown to local research facilities and so it’s actually hard to get folks to participate in in-person research compared to pre-Covid. And what has taken its place is a lot of product testing, a lot of non-traditional work that people have found that, you know, post-Covid, they’re needing to test new products, new product ideas, new concepts, and so they’re bringing that into the facilities. A lot of usability testing. But the day of the traditional, you know, Mad Men-esque six people around a table, that really isn’t happening in person nearly as much as it used to. I mean, I think that’s probably dropped 70% or more. So, what we do in the facilities has changed. And for the world’s largest focus group facility operator, like, we’re starting to think about our footprint differently, like, you know, the big conference rooms with the creepy glass wall on the side, you still need that, but you also now need almost like auditorium-sized rooms that we can get a hundred people in to do different types of research, and then we need a lot more IDIs than we needed in the past for, you know, product testing, usability testing. So, you know, we think that you’re going to see your facilities over the next five years or so really become kind of small, medium, large rooms, whereas before it was all mediums. And so, it actually has an impact on the physical layout of the in-person facilities.

Lenny

Yes, many test kitchens focus on sensory evaluation.

Sure. A lot of test kitchens? Sensory—

Isaac

Test kitchen, yeah. -> Yes, a test kitchen.

Test kitchen, yeah.

Lenny

Yes.

Yeah.

Isaac

Many facilities in commercial buildings do not allow commercial test kitchens, which creates logistical challenges. However, in-person research has returned in a different form after the pandemic.

Which, you know, are tough because a lot of facilities are in commercial buildings that don’t allow you to have commercial test kitchens. And so, like, it creates all these really interesting logistics challenges. But there’s no doubt that the world has changed in in-person research. It is back. It is back differently, but you know, I get people all the time going, “Oh, people are really doing in-person groups?” And I say, “Yeah, they are just different than they were pre-Covid.”

Lenny

The alignment with GRIT in asking about methodology has been observed. This trend has remained consistent, even during the challenges of 2020. It is a relief that the fear of the metaverse taking over has not materialized on a large scale.

Yeah. Which absolutely aligns with what we’ve seen via GRIT with asking about methodology, right? We saw that flip. And we’ve seen over the past few years and figured when 2020 hit that that was one of those things that would stick, right, just like working from home. But I’m glad that it is back to the level that it is. So, that’s fantastic. You know, because the next great fear would be as we go move into, you know, the metaverse, what would that do? But thankfully, that hasn’t happened yet. At least not at scale.

Isaac

It will have an impact eventually, but not on a large scale.

Not at scale. Not at scale. You know, I think it will have an impact at a point, Lenny, no doubt. And it’s coming, but it will take some time.

Lenny

I agree. There is something else that I'm trying to dismiss, but it's an obvious one when we consider the data points. However, you found some interesting information, especially regarding incentives.

Yeah. Yeah, I agree. All right, so what else that was one that’s—I’m trying to dismiss it—it’s kind of an obvious one when we think about and looking at the data points, but you found some stuff, particularly around incentives.

Isaac

We have a problem with respondent engagement in our research. Before Covid, it was easier to get people to participate and attrition rates were low. During Covid, people had more free time and were more willing to participate. However, now that things are returning to normal, people are less interested in participating in research. We have seen a shift in consumer behavior and have had to increase incentives to get people to participate. The value proposition of research has decreased and people are finding other ways to make money. This is causing a problem for the industry as we are paying more to recruit panelists and struggling to find qualified respondents.

Yeah, yeah. You know, again, from, from, from the thousands and thousands of people we recruit every year, we’ve got a lot of data to rely on. And so, one of the trends that has been picked up by a lot of folks and that we spend a lot of time with our clients consulting on is we have an almost an existential problem with respondent engagement. And I know that sounds like a little Chicken Little, sky is falling, but as eart—like, earlier today, I was looking at some of the attrition numbers in some of our various qualitative and quantitative panels and they are much, much bigger than they ever were pre-Covid, and a few things are driving that. So, I talked about in my presentation, kind of these three phases around the research world, and it was pre-Covid, Covid, and post-Covid. Pre-Covid, we had these general expectations about what incentives were, and you could get consumers to do online discussion boards, webcam interviews, in-person research at certain rates, and everybody kind of knew what those rates were, and you didn’t even have to ask. And then something funny happened in Covid. Everybody was sitting at home and so they had tons of free time, and so actually, we had this kind of blissful 18 or 24-month period where people, like, were much, much easier to bring into research. And they were, like, so much easier, I don’t think we even recognized it at the point. We didn’t have incentive pressure, our engagement numbers were super high, our attrition rates were low, and that is kind of qual and quant. And then about a year ago, we saw it shift back super dramatically. So, people all of a sudden, as they were getting out of their home and finding other ways to fill their time and think about things, we have seen a dramatic shift in consumer behavior towards research as a whole. I believe that we have kind of spoiled ourselves during Covid and pre-Covid on how easy it was to bring people into research, and we’re struggling, man. We’re really struggling. We have found that consumer incentives have gone up 20 to 40%. And that’s a big number, right, when you think about a qualitative budget, to increase that by 20 or 40%. That’s huge. And that’s just on the consumer side. We see some B2B categories where we are paying over $1,000 an hour as an incentive to a B2B respondent. Because honestly, like, they’ve got all these other ways that they have found that they can either fill their time, make money, and the value prop of research has gotten really, really low. The screeners have gotten longer, especially during Covid. People just through everything but the kitchen sink into their screeners. So, the dropout and abandon rates on qualitative screeners are through the roof. People are demanding more money for getting into those groups. They’ve got things like TaskRabbit, and Uber, and Lyft that they’re all back doing now that can supplement their income and they’re like, “Why would I go through all this pain and headache to try and get into an online focus group when I can go out and make more money doing something on one of these digital platforms?” And we hear that time and time again and it’s causing a real existential problem for the industry. We’re paying more to bring new panelists in, our panelists are expecting more as an incentive, and unless we get in front of this and do a better job, frankly, of PR about why people would want to participate in research—because a lot of people think it’s the creepiest thing on earth to be asked all these questions—we’re going to run out of qualified respondents at a point, probably not in the too distant future, where it’s just going to get harder and harder and harder to do the research we need to do.

Lenny

This is not surprising. Isaac, I wanted you here because you have firsthand experience with this issue. It has been a problem for a long time and now it has reached a critical point. We need to reconsider our value to consumers because there is too much competition. I agree with everything you said. Even though we resisted when California included research in the gig economy, part of me agrees with it.

Yeah. So folks, this shouldn’t come as a surprise, right? This is why I really wanted you on, Isaac, because you’re seeing it where the rubber hits the road, right? Because of your volume, it’s unmistakable. But this is a problem has been brewing for a hell of a long time, and then we just reached the perfect storm situation. And it’s just something that we must rethink what our value proposition is to consumers. There’s too much competition across the board. And you said it, I don’t need to echo it back; everything you said, I agree with wholeheartedly. Even though we pitched a fit when California wanted to group research in as part of the gig economy, there was also a part of me was like, well, hell yeah. We do.

Isaac

We're competing with it.

It—well, that, that’s—we’re competing with it, so, like—

Lenny

We need to think like successful companies such as Uber, TaskRabbit, TikTok, Twitter, and Facebook. We should learn how to engage with consumers and provide value, just like these businesses have done. In the past, we expected people to participate in surveys without any incentives, but times have changed and we need to adapt.

Yeah, and so we better start thinking like Uber, TaskRabbit, you know, et cetera, et cetera, as well as TikTok and Twitter and Facebook. You know, how do we engage? How do we deliver value? We have to think like marketers because those businesses have been incredibly successful at building the value proposition for consumers to engage and perform tasks for a reward that—whether it’s social or fun or compensation. And we’ve always had this expectation as an industry of, well, no, you just do it because it’s, you know, the right thing to do, right? And, you know, we fought to even offer incentives. So, maybe you’re old enough in the industry to remember some of those debates of, oh, if you had pay somebody to participate in a survey, then it’s just bullshit, right? It’s like, well, the world has changed and we must adapt.

Isaac

The value proposition is not just about money for compensating people. It's important to consider if you would want your loved ones to take the surveys that are being conducted. Most people wouldn't want their family or friends to go through long and tedious surveys. If we want consumers to participate, we need to make the surveys more enjoyable and easy, like watching TikTok videos. Thankfully, people are starting to take this issue seriously, but we need to act quickly because engaged respondents are leaving at a fast rate.

Well, you know, Lenny, it’s the value prop isn’t just about the money that you have to compensate people. I think it’s a part of it, but like, it’s a fun exercise to do to talk to researchers and say, “Hey, like, let me ask you a question. If you took the last quantitative survey that your company fielded or the last qualitative screener, would you make your mother take that?” And everybody laughed. And they’re like, “What do you mean?” And I’m like, “Well, like, how long was it?” And people will be, like, “20, 30, 40 minutes quant survey.” And I’m like, “Would you encourage your mom to do that?” Like, you know, “You love your mom and everybody loves your mom, and—but would you want a friend or a relative to, like, actually take your survey?” And, like, every—like, almost everybody goes, “No.” And so, you go, “Well, that is some cognitive dissonance right there, we need to come to grips with.” If you know the people that you love and appreciate in your life, if you wouldn’t put them through the punishment of a 45-question quant survey? How in the hell are you going to get consumers who don’t care about you or your brand or anything else more than, you know, whatever else is going on on TikTok and Facebook, how are they ever going to want to complete the surveys that you have? Complete the screeners that are getting longer and longer and longer. And I mean, the truth is, Lenny, until we can change the tide of this and make these instruments of data collection competitive with something fun and easy, like, watching TikTok videos, we’re going to continue to see this trend go in the right direction. Now, what’s what is heartening is, you know, you and I have obviously been observing and talking about this industry for over a decade, and this has been given lip service, frankly, for most of that time. People are actually starting to take it seriously now. So, you know, we are getting invited—Sago is getting invited to sit down with folks. I mean, I did it literally today and say, “Let’s look at this screener that we’ve written.” This one this morning was 29 questions, I think was what the average person was going to get. And I said how are we going to get this down to 12? Or 14? Because I’m not going to be able to field this study for you—full stop—unless we make it more accessible for those consumers. So, people are starting to take it seriously. And so, that’s heartening. We better hurry up because the pool of engaged respondents today is leaving at pretty dramatic rates, and we got to get in front of it.

Lenny

Brands are paying attention to the importance of data and recognizing the economic implications of throwing away low-quality samples.

Yep. Yep. Agree wholeheartedly. And brands are paying attention, too, right? And it’s not just that the usual suspects, you know, P&Gs of the world that have always kind of led the charge, but eh, you know, not much really happened. Brands are recognizing it. Because they’re seeing in the data, not just from a quality standpoint, but also you throw away 30% of the sample because it’s bad quality, but then also economically, does that make sense? Like we just paid for, you know, 30% of something we threw away? So, I think folks are ma—are connecting that tissue. Are you seeing that with brands, your direct brand work?

Isaac

Brands are realizing that it is not acceptable to punish their customers by subjecting them to surveys. This change in attitude is due to the increased attention being paid to the brand experience and the recognition that it is wrong to put consumers through surveys. This shift is slow but necessary, and it is ultimately a positive force that will lead to changes in behavior within the industry.

Absolutely. And you know, I hear some really positive things from brands that are kind of new for our industry, things like, wait, are we saying that these are our buyers, these are our customers, the people who drive our revenue and we’re going to punish a thousand of them? Like, that’s a bad brand experience. And so, I’m hearing that more and more that researchers, CMOs, folks that are in charge of the brand experience for the brand as a whole are going, “It’s not acceptable for us to punish our consumers in this way and put them through surveys.” Like, sure it’s a blinded instrument and all that kind of stuff, but still, like, this just is the wrong thing to do. So, people are paying much more attention than they did pre-Covid. And I do think the ship has started to turn in the right direction. It is slow, but we’re going to be forced to. And I think it’s a good force, to be honest with you. Like, I tell people all the time, they’re like, “Why are you charging me more for incentives?” I’m like, “I’m not charging you anything.” Like, these consumers are what—consumers are charging you to play ball. And so, you know, we are coming to grips with it as an industry and I think it’s gotten to the point where it’s going to make us change our behaviors in a positive way.

Lenny

Generative AI has emerged as a game-changer in conversations with suppliers and brands. It fulfills the promise of big data by synthesizing vast amounts of information, allowing us to create virtual audiences and respondents. This has significant implications for the industry, as questionnaires will become smaller and we will rely more on AI to fill in information gaps.

All right, so let’s add a little more insult to injury then on this conversation because here came generative AI. And, you know, and it’s not just a buzz term, is I think about the conversations that I have, both with suppliers and with brands, and particularly with brands right now, they are all-in on that promise that we had with big data back in the day of, you know, we’ll have the who, what, when, where, and how through all of the synthesis of all this data, but we couldn’t quite pull it off because we didn’t have the right technology to synthesize it. Well, now we do. And the implications that we’re seeing right now on creating virtual audiences, you know, virtual respondents, that is huge, huge. So, if we can’t get people to—well, let me rephrase that and there’s two issues here that we have to come to grips with. One is when we don’t need to ask as many questions because the data is available through lots of other sources, that has very pragmatic implications for the industry, period. So, questionnaires are going to decrease in size, you know, et cetera, et cetera. We get into filling the gaps of information versus trying to ingest a whole lot of information. So, let’s recognize that. And then secondly, as they recognize the opportunity to build out these virtual audiences and these virtual models if we can’t even deliver people to fill in the gaps of information, it’s only going to drive more reliance upon utilizing AI to fill in the gaps.

Isaac

At Sago, we have a lot of investments in AI and partnerships, and we are exploring how AI, particularly generative AI, can assist us in various aspects of our workflows. The obvious areas where AI can be helpful are reporting and analysis. We have tools that aid us in these areas, and it is completely assistive. Another area we are looking into is synthetic audiences, where we use some initial data from real humans and then project and predict what a larger audience would say. This concept makes some people uncomfortable, but we need to remember the core purpose of our research, which is to inform business decisions. As long as the results of generative AI are accurate and help drive the right business decisions, it shouldn't matter if it comes from real humans or not. The businesses we serve want to drive revenue by understanding consumer wants, thoughts, and behaviors. If generative AI can achieve this as effectively as talking to a thousand real humans, we shouldn't be concerned. However, consumers will always be necessary in the process, as AI is good at matching patterns but struggles with new data sets. We need to find ways to augment and accelerate the consumer's voice using this technology, rather than being afraid of it. If we don't embrace it, we may be left behind by technology players who can answer business questions better, faster, and cheaper. But I have faith in our industry's ability to incorporate this technology into our practices and improve because of it.

Yeah, I think you’re right, Lenny. I mean, we obviously at Sago have a lot of investments in AI, we’ve got a lot of partnerships, a lot of our own technology, and we are looking across the entire spectrum of our workflows and seeing how could AI or even generative AI help. And I think, you know, the obvious areas are reporting and analysis. And, you know, there’s a lot of good work being done there; we get a lot of tools in our toolkit that help us there and it’s totally, totally assistive. And I think that’s kind of the obvious one. The next one that you touched on was this idea of what we call synthetic audiences. And you’re right, you do need, in most cases, some genesis data that you need to get from, you know, live, breathing humans at this point, but then you can do a lot with that synthetic data projection and we’re starting to see some really interesting results from that. And that makes people a little queasy, I think, you know, when you think about synthetic audiences and having AI predict and project what a larger audience would say, people get nervous. And I keep coming back to, like, the core question of why we do research. And, you know, we get away from that a lot. And I think, you know, we’re not in business just to talk to consumers. Like, we’re in business, to actually help inform business decisions, right? And so, should we really care if the results of generative AI are as good or better in whatever measure you have to help aid business decisions? And I don’t think we should really get wrapped around the axle about whether it’s talking to a real human being or not. The businesses we serve, they want to drive revenue, okay? And they want to drive revenue by knowing what consumers want, think, and their behaviors. And if generative AI can plug that gap as well as talking to a thousand living breathing human beings, I don’t know that as an industry we should care. We should care that the results are accurate in the sense that they drive the right business decisions, but I don’t think we should get all wrapped around the axle about this idea whether it’s coming from a hundred percent live consumers or not. There’s always going to need to be consumers at the table. I don’t believe, in your or my time in this industry—and hopefully, I’ve got a few more decades left in this industry—that we will fully see the consumer just sat down and technology drive everything. The Terminator I don’t think is coming for our industry. Because, you know, at this point, AI is really good at matching patterns, right? Well, if you don’t have any existing data to train it on, like, if there’s a brand new product category or brand new idea, what is the data set that you need to point that artificial intelligence at? And the answer is, this is really, really tough to do. So, we will always need the consumer to have a seat at the table. The question is, how do we augment their voice? How do we accelerate their voice using this technology? And I don’t think it’s something we need to be scared of. I think it’s something we need to embrace. And frankly, if we don’t figure it out and embrace it as an industry, we may see the industry pass us by a little bit. We may see technology players who do figure it out and jump into this space and be able to answer business questions better, faster, cheaper than we can as an industry, and that could pose a real challenge for us. But I have faith in this industry and I have faith that we will figure out a way to embed this into our practices over time and be better for it.

Lenny

Utilizing existing data for targeting people is a common practice in advertising and other areas. Research will always be necessary to gather more data because society and individuals are constantly changing. Companies like Sago with panel assets will play a vital role in this process.

Yeah, I couldn’t agree more. And so, this idea that we’re talking about, this has been—in a much less sophisticated level—been done within advertising, you know, other areas for a long time, right? The idea of utilizing—political polling. You know, targeting folks off existing data is something that is normal and customary. So, it’s not a leap to think about how we do that now. But I agree with you that there will always be a need for research to provide more data inputs because things change, just as we just talked about the shift from pre-Covid, Covid, post-Covid, right? And it seems like the world is not letting up on, you know, these pressures that are changing society, changing cultures, changing people individually and how they adapt; it just continues on. And so, those gaps of information will continue to be there and research is the ideal way to do that. And really, I think that the panel companies, companies with great panel assets like Sago are going to be vital in helping to do that, not just the field services, right? We still need to ask the questions. But the assets that are being built and organized around not just engagement, but also kind of the data graph, right, of building profiles of information, those are those training sets.

Isaac

At Sago, we believe that having access to consumers and business people is crucial for building training data and projecting new ideas. We have millions of consumers in our panel assets, and we put a lot of effort into collecting the necessary data to train AI models. This conversation is very important to us at Sago.

That is our belief at Sago for sure that, you know, having access to those consumers, business people to help build that training data, to help project the things that nobody’s asked a question about if there is an existing data set, that is going to be a real key fundamental part of our business. And, you know, when we think about building our panel assets and we’ve got, you know, access to millions of consumers and the depth we know about them and how we start building that out, we put a lot of effort behind what data do we need to collect to help train these AI models that might not have been terribly relevant for survey data collection or qualitative collection, but could be relevant in a data training world that’s a very active conversation here at Sago.

Lenny

Companies are recognizing the value of data and are starting to protect it by charging for access. This will lead to the creation of exclusive data panels and communities that will enhance the internal value of the data. This presents an opportunity for the industry to consider how to enable this type of data asset and fill in any information gaps through research.

Yeah, and I think—so here’s my prediction; see whether you agree. Now that I think that the generative AI thing has really put into focus the value of data as a whole. And we’re already seeing companies, I think last week, Reddit said, “Nope. We’re putting a moat around our data. You want access to Reddit content for your training sets? You’re going to pay us for that.” Brands are recognizing that as well. And I think we’re going to see the emergence of proprietary panels and communities as part of that data asset that they’re building moats around to build that internal value. So, I think that’s a really great opportunity for the industry to think about, what does it look like to enable that type of data asset at the core, that is then fed by research, right, that’s focused on all the business issues that we already think about to fill in the gaps of information? So, what do you think? Am I full of it, or uh—

Isaac

We are already seeing an increase in business from brands who want to work with us on collecting and analyzing proprietary datasets. They may not know exactly how they will use the data yet, but they recognize the importance of having it. We have several ongoing projects in this area. The market research industry is also changing, with more focus on collaboration with select partners and aligning datasets. This shift is driven by the realization that sharing too much information and not having access to first-party data limits the ability to build comprehensive datasets. At Sago, we are actively working on acquiring premium first-party datasets and narrowing down our partner list to ensure better alignment and a more successful business.

Oh no, you’re not full—Lenny, that’s already happening. Like, you know, we have a fairly large amount of business these days coming from working with brands on proprietary datasets, visual data, textual data, all the things that are relevant to their brand, and they’re starting to build these datasets. And in some cases, you know, we are helping them collect the data. And they don’t even know what they’re going to use it for yet, right, but they know that they’re going to need it And so, we have several major client projects underway right now doing exactly that. So, I don’t think that’s, like, I’m going to take that bet and I’ll be on your side of it because that’s not going to happen; it’s already starting to happen because they are realizing that this, especially, hybrid proprietary data is something that they need to be collecting now. And, you know, you used the Reddit example of, you know, creating these walled gardens. I think it’s a good one. So, I’m a big Reddit fan. I am on there a lot, and I’ve watched this kind of interestingly because I think it’s got an implication for our business. In market research, it’s been an extraordinary amount of coopetition, right? So, especially on the quantitative side, there’s a lot of collaboration to get sample filled, there’s a lot of collaboration about opening up panels, there’s exchanges. We’re starting to see those things close down. We’re starting to see the collaboration really be less open and much more focused. And so, you’re picking more premium partners to work with, you’re aligning your datasets more. And I think it’s for two reasons. Number one, I think the openness that we were sharing, consumer access, we realized, whoa, whoa, whoa, like, we were giving away some of our proprietary secrets in some ways. And number two, we weren’t really in a good position to start building these deeper datasets, unless you have this first-party data access. And so, we are at Sago, we have a lot of work and effort in this space to make sure that we’ve got the right first-party premium datasets for our customers. And then also, as we work with partners, we’re kind of narrowing that partner list to work with folks who we can align datasets, we can understand things on similar levels. And I think it’s making us run a smarter, better business.

Lenny

It's good to hear that the industry is moving in a positive direction and that companies like yours are leading the way. I remember talking about this idea ten years ago and thinking it would be scary and weird, but we would eventually get there. I just didn't know what technology would make it possible. So, it's great that we've reached this point. Can you share some other important findings from your report that the industry may not be considering?

That’s great to hear, not just because I like being told that I’m right. But the—although I make my living by… you know, pontificating and then being right, so it’s good to have that validation. But I think it’s a positive vision for the industry. I mean, I remember giving talks on this idea ten years ago and thinking, you know, “Look, it’s going to be scary. It’s going to be weird. It’s going to—but we will get there.” What I couldn’t understand at that point was what was the technology that would unlock it. So, it’s great that we’re there now and that companies like you were leading that charge. So, I want to get back to a couple of the data points that you brought up in your report. So, what were some of the other findings that you think that the industry needs to hear that maybe they’re not thinking about?

Isaac

One of the major challenges we face is keeping participants engaged in our research. Additionally, as an industry, we were not proactive in our research design when it came to digital qualitative research during the Covid pandemic.

Well, you know, we talked about I think one of the big existential one is how we keep respondents engaged in our research. I think another thing that we have seen, specifically looking at digital qualitative is, going into Covid, as an industry, we were a little bit lazy about how we thought about research design

Lenny

I have many layers.

I am multilayered

Isaac

We are well aware, aren't we?

Oh, don’t we know? Don’t we-

Lenny

Thanks.

—thank you.

Isaac

Do you understand?

—know?

Lenny

Is the technology making it easier now compared to before to make what you're describing usable?

And back to our previous point, too, the technology is making that easier now, right? I mean, before what you’re describing, there was a whole lot of work involved to make that usable.

Isaac

It's now as simple as clicking a button to invite someone to a video interview. This method allows for a deeper understanding of consumers compared to traditional methods like focus groups. Combining different research methodologies provides a more comprehensive understanding of the consumer's thoughts and answers important business questions.

Oh, it’s a click of a button now. And, like, like—and, you know, I still find researchers who are blown away and I’m like, “Hey look, you’re doing an online discussion, our platform, click this button and Linda gets invited to a video interview tomorrow night.” And they’re like, “Wait, is it that easy?” And I’m like, “Yeah, and it’s been that easy for a long time,” but now we see the value in it. And it’s not just about being able to get more data out of Lenny. It’s about learning more about you and learning in different ways and, honestly, providing a richer understanding of who you are as a consumer than just in a, you know, in a 60-minute online video interview. And, Lenny, I can tell you a story this is not just a digital story; this is an in-person story and I could tell you all sorts of stories about when you get people together in an in-person event and then you talk to him on a digital scale afterwards, you follow up with them two weeks later, you’ll learn things that they didn’t tell you in the focus group. You’ll learn things that they wouldn’t have shared in front of a group of three or four individuals. And so, none of those methodologies are wrong at all. They all have pluses and minuses, but the combination of multi-method gives you that ability to understand multiple dimensions of Lenny. And it honestly answers a more robust business question about what this consumer is thinking.

Lenny

I agree that all the changes we're discussing will bring about a qualitative golden age in research. Research will become more experiential and focused on engagement rather than just quantitative measures.

Yeah. Yeah, agreed. And I would also say that I think—not to keep going back to it, but I think it’s relevant—that all these changes we’re talking about usher in a golden age of qual. I think that research as a whole is going to look and feel experientially be far more qualitative in the way we think about it from a discussion standpoint—I’m not talking about sample size; just the, you know, the techniques of engagement—than it will be quantitative.

Isaac

I agree that qualitative research is experiencing a resurgence in the industry for various reasons. While quantitative data provides a wealth of information, qualitative research allows us to gather stories and experiences directly from consumers, which brings the data to life. It is important to incorporate both methodologies to gain a comprehensive understanding.

I agree. And you know, as, you know, the president of Sago who does both qual and quant, I can’t, like—I love both of those methodologies. That being said, it is a very common refrain in our industry that, you know, qual may be in a resurgence at this point for a bunch of different reasons. Over-reliance on quantitative data, difficulty in getting the right audiences, you know, pick your poison, there’s lots of reasons why people may be incorporating qualitative more. But you know, for me, the beauty of qual is—well there lots of things I appreciate about qual, but one of the things a friend of mine once told me, “You know, Isaac, we don’t tell our kids bedtime facts, we tell them bedtime stories.” And the story sticks with you, right? And you get such an amazing story from your consumers from qualitative. You get all the data in the world you want from quant. You can make stories from quant but there is nothing like seeing the written word of your consumer, seeing somebody on video, seeing how they actually go plant that garden, and it just brings it to life. And again, I could tell you, I could sit here for the next four hours and tell you stories about brand managers from, you know, very well-known, respected brands who question results from qualitative because they’re like, “Well, we’ve never seen people do that. We’ve never heard people do that. And I’m like, “Well, why not?” And they’re like, “Well, you know, we don’t do a lot of qual. We had no idea people would do this.” We were doing a study one time on appliances in homes without microwaves and we had a bunch of IDIs, and—it was a multi-method study. It was pre-Covid. It was a kind of an early multi-method study. And so, we’d actually gone on shopping trips with these individuals, and then we did online at-home diaries. And we had a respondent who had aluminum foil around their microwave. Okay? And—

Lenny

However, not in

But not in—

Isaac

Exclude.

Not in.

Lenny

Hopefully

—hopefully

Isaac

A photo captured on our platform led a researcher to investigate a person's belief that there was a radio emission. This person, who had a new baby at home, started putting aluminum foil around their microwave as a precaution. We discovered that two other people in the same group had the same fear. This revelation surprised a brand manager from an appliance manufacturer, who had never realized this concern existed. Qualitative research allows for exploration in unexpected areas, unlike quantitative research.

It was in a photo that was captured in our platform. And so, the researcher came back to us and said, “Hey, we got to probe what was going on there.” And turns out this person had a belief—true or not true, I’m not sure—that there was some sort of radio emission. She had a brand new child at home and so she said, “You know, better safe than sorry. I don’t know. It’s maybe weird, new protected mother, you know. She got this little baby at home. I’ve—yeah, I’ve started putting microwave around my microwave—or rather aluminum foil around my microwave, just to—just in case.”And you know, what’s funny? Like, the client was like, “Oh, my gosh. We got this person that has this weird kind of thing.” And so, guess what we did, we actually asked people in that same group on our online discussion, said, “Does somebody else have that same fear?” It turns out there were two people in that group of thirty who did the same exact thing. And about half the audience said, “Yeah, I could see how like—you know, now we’ve got questions about it.” And so, here’s this brand manager from this very well-respected appliance manufacturer going, “Oh, my God. I had no idea that people felt this way about this type of appliance. I’ve never asked that question in a survey and I only learned it because we observed it in a photo and then you blow it up and you find out, oh, my gosh, it’s not just this one person. There’s a whole kind of undercurrent of this concern that we’ve really never tapped into.” So that, I think, is the beauty of qualitative is that you can explore in places that you didn’t even anticipate. And you know, with quant being a little bit more on rails and being able to give you large projected datasets, the beauty of qual is you can really explore with the consumer like you can’t in other methodologies.

Lenny

Yeah. It's a great story. As someone whose wife buys lots of Shungite, I put it all around, it's a stone.

Yeah. And what a great story. And as somebody whose wife is made—buy lots of Shungite to put all around all of the—it’s a stone—

Isaac

That was something I hadn't experienced before.

Okay, that was a new one for me.

Lenny

We use Shungite throughout the house to absorb EMF radiation.

It’s a stone that absorbs EMF radiation. And we have Shungite all around the house to try and

Isaac

Here you go, Lenny. You should—

There you, there you, there you go, Lenny. You should—

Lenny

Electromotive force (EMF) can be paraphrased as the force that drives electric current in a circuit.

EMF.

Isaac

You should have been in our qual board discussion because you would have been a great audience for this brand manager.

You should have been in our qual board discussion because you would have been, you would have been a great audience for this brand manager.

Lenny

It's better to be safe than sorry. I once did research for Kimberly Clark and found that car collectors were a big audience for a specific type of cleaning cloth, not janitors.

It’s an interesting question, right? So, better safe than sorry. But as I sit here with my WiFi router, right? But that’s a great point. I remember doing research for Kimberly Clark back in the Rockhopper days on cleaning cloths and discovered that a huge audience for them for these clean—this—I forget this specific type, but it was very lush microfiber, you know—wasn’t janitorial; it was car collectors.

Isaac

Oh, I see.

Oh, right.

Lenny

The product was excellent for polishing cars and didn't cause any scratches. It even led to the creation of a new product category. This discovery was made through qualitative research, which revealed that janitors were taking the product home and using it to clean their cars instead of throwing it away.

—because they—it didn’t leave scratches, it was great for polishing, you know, their car babies. And it launched a whole other product category. And that was done through qualitative research to identify. Because we found out that janitors were taking them home, right? And—rather than throwing them away, they were repurposing them so they could clean their cars.

Isaac

Qualitative research helps uncover interesting uses for baby wipes and allows us to better understand consumers. This knowledge helps us create better products and services, ultimately making the world a better place.

Makes perfect sense. And you know, those are the kind of things that I think qualitative can really help you uncover. And one of the reasons I love this industry is—because I’m always just totally curious about the human condition and finding people who have these, you know, interesting uses for baby wipes. Like, it makes me want to go do it myself, right? And so, you know, consumers are just these fascinating animals. And I love being in an industry where we get to where we get to be really in service to them. Because at the end of the day, we’re trying to make better products and services for them by learning about what they do. And if Kimberly Clark wanted to make an automotive product that worked better than the competing products and they learned that in research, I think that we made the world a better place because of it.

Lenny

I completely agree and want to be mindful of your time and the audience. Did you find any other significant findings in your quantitative research that we should discuss?

Yep. Absolutely, absolutely agree, right, wholeheartedly. So, I want to be conscious of your time as well as the audience because you and I could go on and on about this type of stuff. So, you did some quantitative research as well. Was there anything—or looked at your quant data—anything else that popped out of that, that we want to make sure that we—

Isaac

We are currently analyzing all the data and finding similar themes in our business engagement.

Yeah, so we’re—we are, we are still in the middle of analyzing all of all the data, Lenny, and we are finding similar themes on the quantitative side of our business engagement

Lenny

Yeah, I agree with you. We discussed the idea of using synthetic samples or virtual respondents to understand audiences at a basic level. It's a useful tool for hypothesis-forming and exploring new concepts. However, we need to be careful not to rely too much on tools like ChatGPT because it can make us lazy. There are platforms like Decktopus that can generate a whole PowerPoint deck in seconds, which can be tempting, but we should strive to stay sharp and not become too dependent on these tools. We need to continue working through the challenges and potential misuse of these tools, such as fraud. It's an interesting time, and I appreciate that you have a lot of data flowing through your organization to stay informed.

Yeah. Right, there with you. And, yeah, we can go off on another tangent on that, but I do want to put the point on it that we talked about this idea of synthetic sample or virtual respondents. The use case seems to be early exploratory kind of concept, understanding audiences at a basic level. Hypothesis, right, hypothesis-forming, which I think is a logical use case. And kind of to your point, if we can get—if we have the data and the system can give us answers that help point us in the right direction to new questions, then I think it’s a useful tool. It may be one we have to be careful of, so I personally, I keep struggling with utilizing the ChatGPT-type tools because I don’t want to be lazy. I see that tendency in myself. There’s actually a presentation earlier this week and we were looking at a platform called Decktopus that ChatGPT creates a whole PowerPoint deck. Literally. Or something related to—I don’t know if it was ChatGPT, but open—generative AI—a whole PowerPoint deck in seconds. And it’s like, man… because I hate making PowerPoint decks, right? But for me, it’s like, I don’t want to get too lazy, right? I want to make sure that I stay sharp. And those are just the types of things we’re going to have to continue to work through is these tools because they’re there, they add value—obviously—and we’re—keep working through them. And they can be used badly, to your point, around the fraud. So, interesting times. And I’m so glad that you guys have so much volume flowing through you that you can get an idea on what’s happening. So—

Isaac

We are proud to be in that position and are committed to providing visibility to the industry through our reports, which showcase trends and important information. We are more than willing to assist the industry in any way we can.

It’s an honor to be in that position. And you know, one of the ways that we’re trying to help—I don’t want to say, “Give back,” but, like, make sure the industry has some visibility into these things is these reports that we’re doing to, you know, just show trends and things. Because at the end of the day, like we want, you know, the industry to know what’s going on, so we’re just more than happy to help.

Lenny

The company's DNA has always been about appreciating and embracing certain values. This was true when you were at Schlesinger, and it remains true at Sago. It's exciting to see. And just to give some context, this company actually started from a simple dinner table.

Yeah. Always appreciate that about the DNA of the company as a whole, right? When you were Schlesinger, you did the same thing. At Sago, you’re doing it. It’s just thrilling. And by the way, for an audience who doesn’t know the story, right, this is a company that started literally at a dinner table.

Isaac

Correct.

That’s right.

Lenny

Doing focus groups at Steve's mom's house, right?

Right? Doing focus groups in Steve’s mom’s house.

Isaac

I've met researchers who debriefed their clients in Steve's childhood bedroom.

That’s right. That’s right. I’ve actually met researchers who debriefed their clients in Steve’s childhood bedroom .

Lenny

It's a great success story. You started the company in your house and now it's one of the largest research companies in the world. Entrepreneurs should see these things as opportunities.

So, what a success story with that, too, right? I mean, you obviously have been inside, but I’ve been privileged to have some views over the years of what was going on and it’s just always been so cool. Just, like, a great story. So, for entrepreneurs out there, right, all these things we’re talking about, they are opportunities as well, and you guys are an example of… literally you know, starting it in your house and creating now one of the largest research companies in the world.

Isaac

Innovation and looking towards the future have been crucial for our organization's growth and success. If we had stayed stagnant and not embraced new opportunities like digital research and global services, we would not be where we are today. It is important to always keep an eye on the future and make informed decisions to move the industry forward.

Yeah. And you know, and on that note, innovation, like you know, keeping an eye to the future because, you know, we have been able to grow and thrive and change because the DNA of this organization is that we are looking to what’s going to come next. If we had stuck in, you know, Steve’s mom’s kitchen table, we would have never grown. If we would have stuck doing just in person, we would have never grown. If we had stuck not getting into quantitative research, not getting into digital qual, not getting into global professional services, we would have not become the company we are today, so you’ve always got to keep an eye on the future. And I think that’s why you know, folks like you educating people on what the future is going to look like, helps firms like us place those bets and really move the industry forward.

Lenny

Do you have anything else to share with the audience, Isaac? I really enjoy when we have a mutual admiration society.

Oh, great. I love it when we have a mutual admiration society. So, anything else that you want to share with the audience, Isaac?

Isaac

I believe this session has been great, Lenny. Thank you for hosting me. We will release our quantitative analysis report on the state of the qualitative industry in mid-summer, so stay tuned. Hopefully, I can come back again.

You know, Lenny, I think this has been a fantastic session. I really thank you for hosting me. I do want to point out, we will be releasing our quantitative analysis report, kind of the state of the qualitative industry, sometime mid-summer, so stay tuned for that. And hopefully, maybe you’ll have me back.

Lenny

We would love to continue this great conversation. Please inform us when GreenBook releases their reports.

We’d love to. It’s a great conversation. I know that there’ll be many more, definitely, and let us know—GreenBook—when you release those reports.

Isaac

We will take care of it, Lenny.

We’ll do, Lenny.

Lenny

That's all for today. Big shout-out.

Yep. And I think that’s it for today. So, big shout-out

Get Started

Unlock the full potential of your qualitative data for a flat fee of only $10 per source. Upload files now.

Optional NDA

For added security, you have the option to send us an NDA before proceeding with your uploads.

Send to nda@135pixels.com and allow 24 hours.

Link to Securely Upload Materials Will Be Sent Here

Send My Secure Link135 Pixels has led Natural Language Processing and AI integration for Qualitative Data Analysis since 2017 and is trusted by firms serving a range of clients, from startups to Fortune 500 companies.